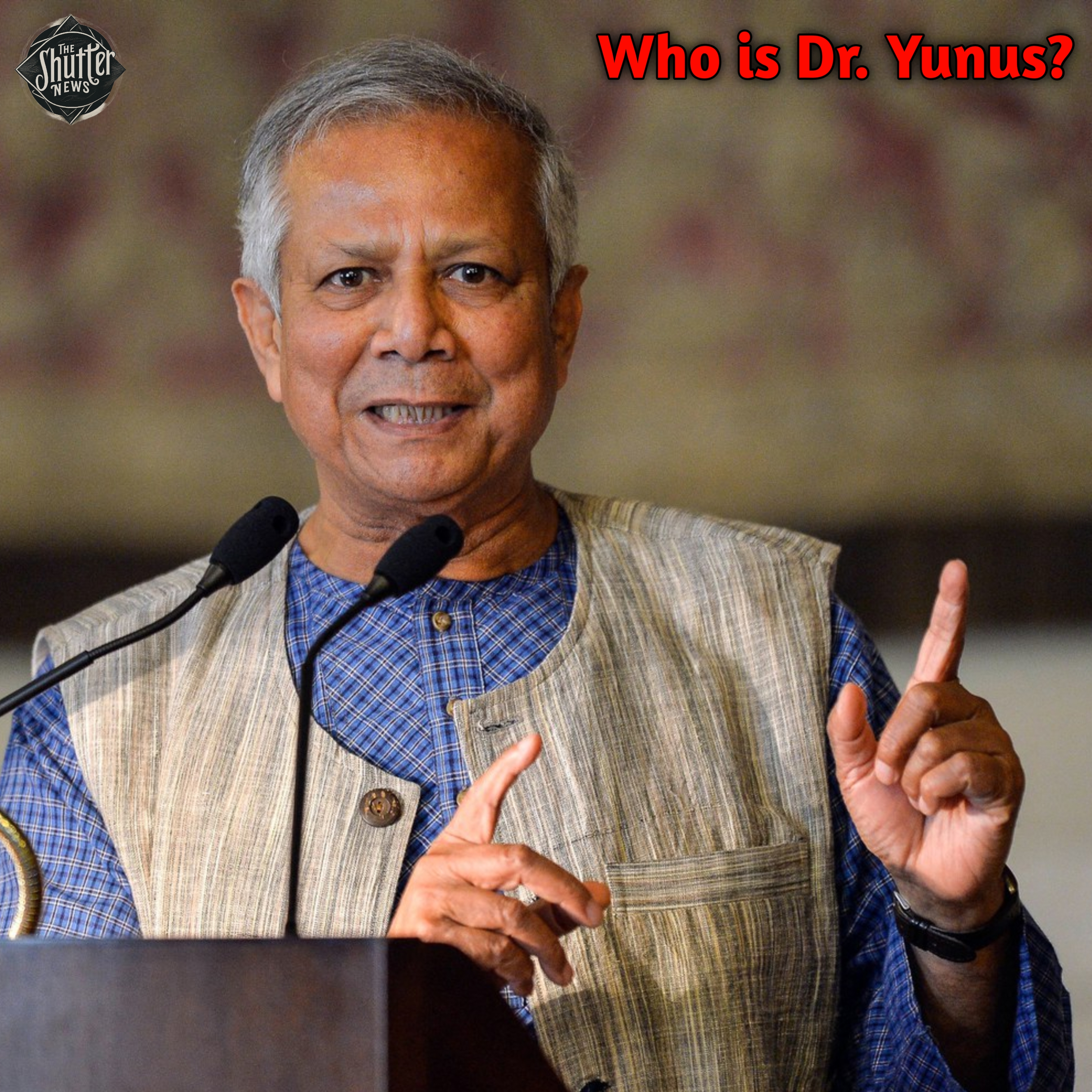

After all, who is this Dr. Yunus??

The youth of Bangladesh have made a demand or a condition for the interim government, showing their love for their motherland, intelligence and determination to shape the future and the choice of merit.

Dr Muhammad Younis is the founder of Grameen Bank in Bangladesh who was awarded the Nobel Prize in 2006 for lifting people out of poverty through microfinance banks.

It is about 1972-73. When Professor Muhammad Yunus of the Finance Department of Chittagong University presented an untouchable project of small loans (micro-financing) to lift the poor people, especially women, out of poverty. The name was Grameen Bank, meaning village bank.

Muhammad Yunus went to every government door for his project, asked for help from every bank and banker, but no one supported him.

Then Muhammad Yunus decided that he himself would start this project from a single village. He founded Grameen Bank in 1974 by collecting 800 taka from his own pocket and 3 thousand taka with the help of friends. Which has no building, no employees. Just a pen and register and 3 thousand taka.

Yunus started from a nearby village in Chittagong. 5 Loans to women for small businesses that the women themselves decided they could improve. Like

Making cloth from cotton

Making beautiful baskets/bread boxes

Poultry and duck farming and egg business

Sewing and embroidery of clothes

Creating a design chart

There was also interest on the loan. He who took a hundred taka will give one hundred and ten taka. But after starting the business and that too on a daily basis. At least one taka per day, or whatever you can afford.

A bank officer on a bicycle used to go to the houses of these women every day and not only bring a tikka. Rather, he used to help them in selling goods. The interest on the loan was actually the salary of the bank officer of the same cycle.

When enough money was returned to lend to the next house, the sixth house would be added.

In this way, the households waiting for the loan should also take care that the businesses of the pawns are successful. Get the loan back in time so that they can also join.

The terms of the loan were also unique

@ Borrower will send children especially girls to school

@ will not marry young children

The debt of those who take or pay dowry on marriage will be cancelled

@ Borrower will plant 10 trees including fruit bearing trees.

@ House, kitchen and bathroom cleaning will be required. They will not eat without washing their hands. Women will take special care of cleanliness during menstruation.

@ A man who beats women or children will not get a loan

After auspicious two years, the fame of economic prosperity in this village began to spread. In a few more years, Grameen Bank had reached dozens of villages. When the discussions started in the media, the government also got interested.

In 1984, the government granted Grameen Bank the status of a regular bank.

When it got international fame, bigger institutions came to see it. The World Bank adopted this model and started implementing the plan to implement this model in 64 countries.

The women who benefited from the same Grameen Bank played the role of an important resource in the industrial development of Bangladesh and left the mark of the industrial revolution.

Today Grameen Bank is taught as a case study in almost every major university in the world.

In 2006, Prof. Dr. Muhammad Yunus was awarded the Nobel Prize for such a wonderful model of micro-financing.

Today, Grameen Bank has 2656 branches in Bangladesh and this is Dr. Muhammad Yunus’ first priority of today’s Bangladeshi youth.